What Is A Deductible Fund Account?

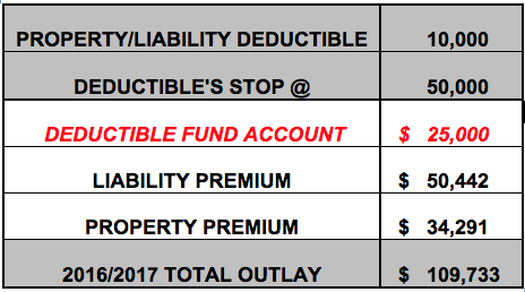

A deductible fund account is an amount of money set aside in an escrow account managed by ACCO’s accounting department to pay the deductibles on all claims filed by a member county for the applicable policy term. The deductible fund dollar amount is located within your ACCO-SIG quote sheet that is mailed out in June of each year and is added into the bottom line. (See below example)

|

ACCO-SIG currently offers three deductible options which are $10,000, $25,000 and $50,000 dollars. Each of these three deductible options have what is called a deductible stopping point which ceases deductible application to a claim once the grand total of all deductible hits in a specific policy term reaches the deductible stopping point.

For example, if a county has a $10,000 deductible the deductible stopping point is $50,000 as in the above example. If a county has a $25,000 deductible the deductible stopping point is $75,000 and if a county has a $50,000 deductible the deductible stopping point is $100,000. |

I fully load some of our member counties deductible fund accounts due to the size of the county or due to high claim frequency and other counties are only partially funded due to their small size or due to low claim frequency as is the case in the above quote sheet example. If the above example was fully loaded it would have $50,000 dollars placed in the deductible fund account instead of $25,000.

Also, it is important to remember that no matter how small a claim may be you can still submit the claim to County Claims of Oklahoma for handling. For example if a county owned truck was in an accident and sustained $10,000 dollars in damages and the involved county had a $25,000 deductible a claim could still be filed with County Claims of Oklahoma and the $10,000 dollars paid on the claim would be extracted from the involved counties deductible fund account to fully pay the claim on a ground up basis.

It is also important to understand deductible fund monies that are not utilized in a specific policy term will be rolled forward at the end of eighteen months from the inception date of the policy term. These unused deductible fund monies will then be re loaded into a subsequent policy term quote which will decrease the amount of deductible funding that is recognized on your quote sheet for that specific policy term. Those counties with minimal to no claims activity will be able to re use prior deductible fund monies in a subsequent policy term which will decrease their bottom line on their respective property and liability quotations.

Therefore it is important to follow safety protocol in your respective counties and reduce the amount of claims that require deductible funding. Those counties with high vehicle accident frequency will deplete their respective deductible fund account balances each policy term unlike those counties with low vehicle accident frequency.

Make sure your sheriff department knows what your counties respective deductible amount is and also understands how the deductible fund account works.

If anyone should have any questions concerning their respective deductible fund accounts please contact me at my direct ACCO line which is 405-516-5318.

Also, it is important to remember that no matter how small a claim may be you can still submit the claim to County Claims of Oklahoma for handling. For example if a county owned truck was in an accident and sustained $10,000 dollars in damages and the involved county had a $25,000 deductible a claim could still be filed with County Claims of Oklahoma and the $10,000 dollars paid on the claim would be extracted from the involved counties deductible fund account to fully pay the claim on a ground up basis.

It is also important to understand deductible fund monies that are not utilized in a specific policy term will be rolled forward at the end of eighteen months from the inception date of the policy term. These unused deductible fund monies will then be re loaded into a subsequent policy term quote which will decrease the amount of deductible funding that is recognized on your quote sheet for that specific policy term. Those counties with minimal to no claims activity will be able to re use prior deductible fund monies in a subsequent policy term which will decrease their bottom line on their respective property and liability quotations.

Therefore it is important to follow safety protocol in your respective counties and reduce the amount of claims that require deductible funding. Those counties with high vehicle accident frequency will deplete their respective deductible fund account balances each policy term unlike those counties with low vehicle accident frequency.

Make sure your sheriff department knows what your counties respective deductible amount is and also understands how the deductible fund account works.

If anyone should have any questions concerning their respective deductible fund accounts please contact me at my direct ACCO line which is 405-516-5318.